HIGHLIGHTS

OVERVIEW

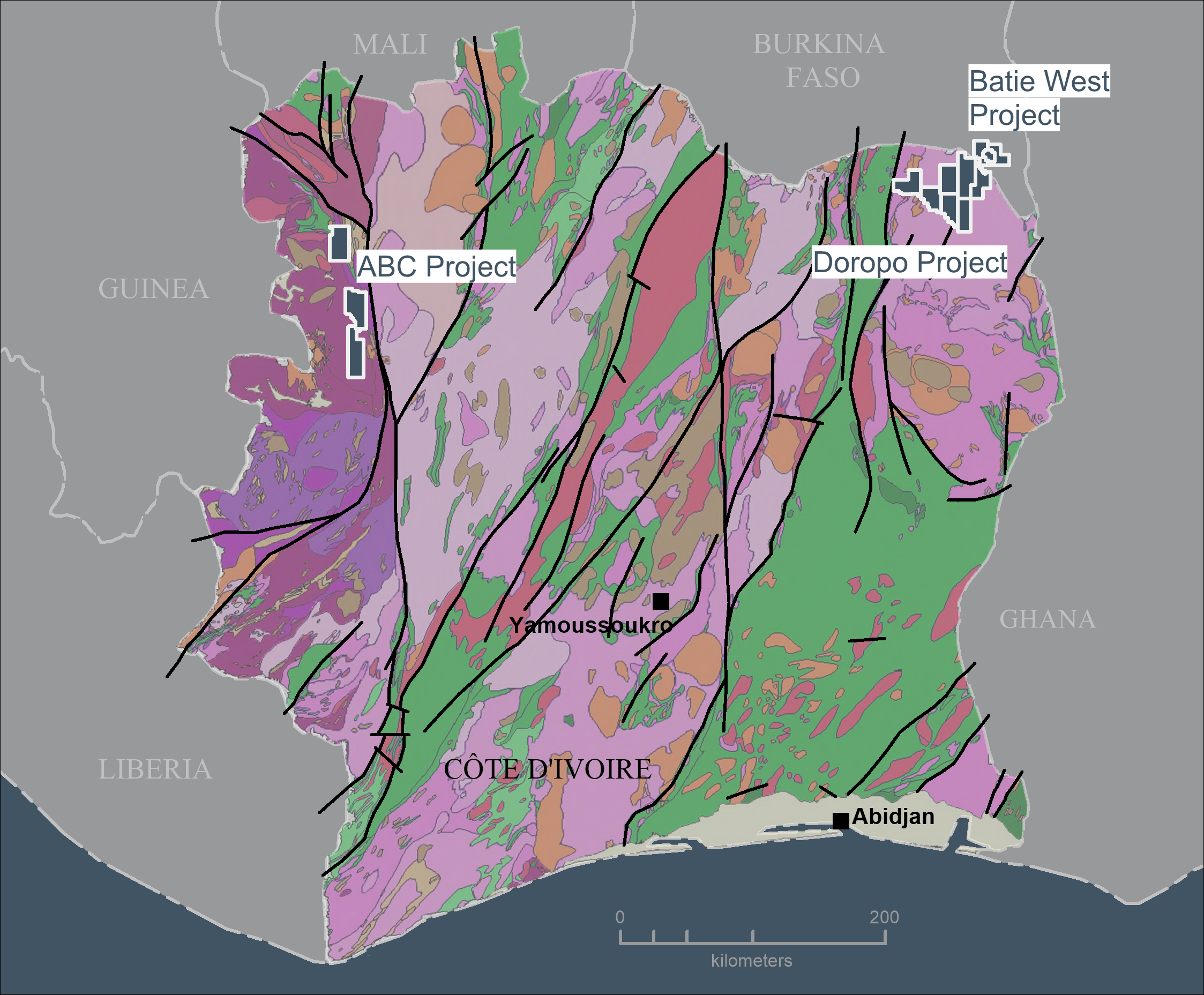

The Doropo Project (“Doropo”) consists of seven exploration permits, covering an area of approximately 1,850km2. Doropo is in the northeast of Côte d’Ivoire, approximately 480km north of Abidjan.

The Doropo Project (“Doropo”) consists of seven exploration permits, covering an area of approximately 1,850km2. Doropo is in the northeast of Côte d’Ivoire, approximately 480km north of Abidjan.

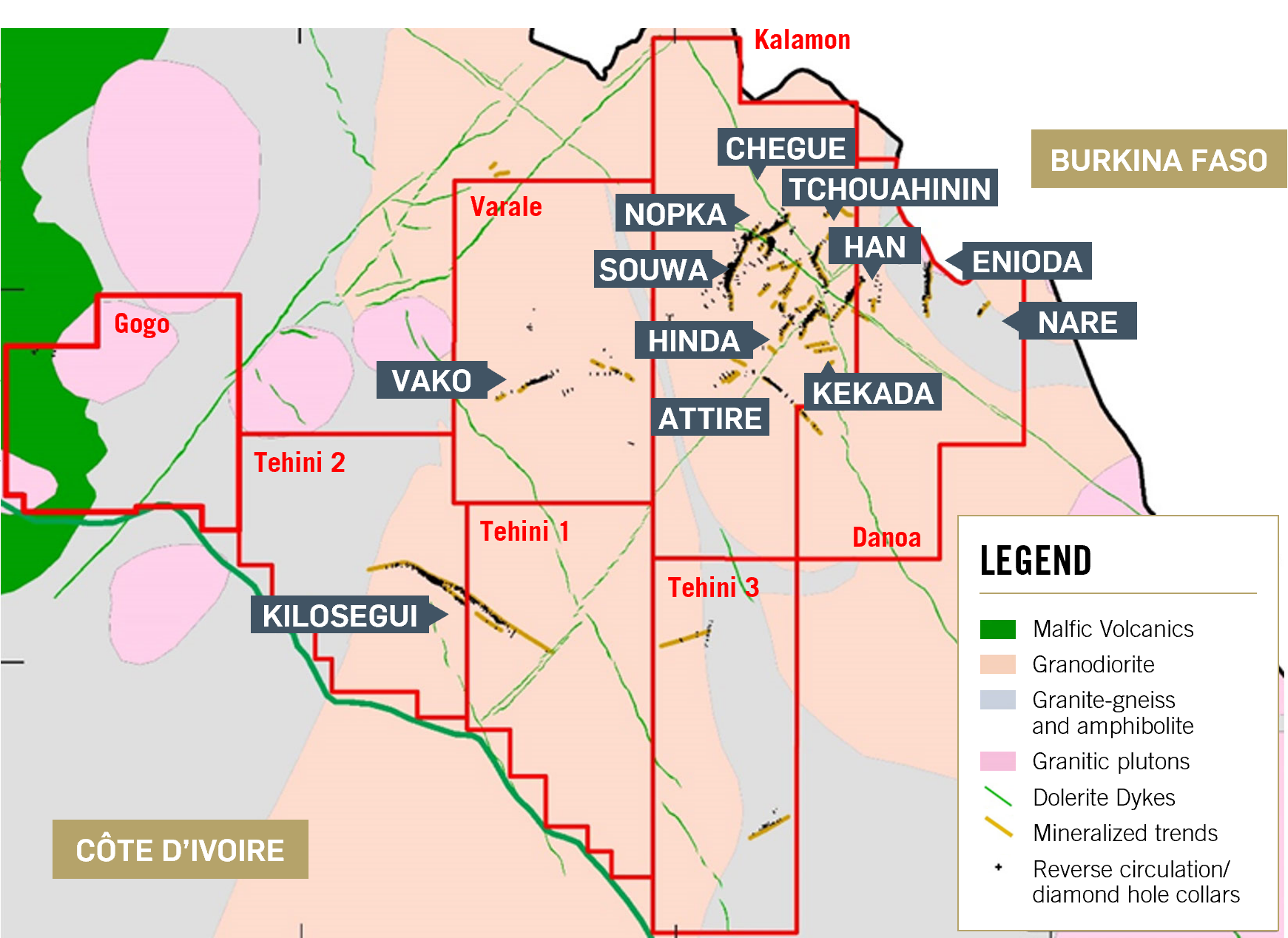

The license holding covers thirteen gold deposits, named Souwa, Nokpa, Chegue Main, Chegue South, Tchouahinin, Kekeda, Han, Enioda, Hinda, Nare, Kilosegui, Attire and Vako. Approximately 85% of the gold deposits are concentrated within a 7km radius (“Main Resource Cluster”), with Vako and Kilosegui deposits located within an approximate 15km and 30km radius, respectively.

Geologically, Doropo lies entirely within the Tonalite-Trondhjemite-Granodiorite domain, bounded on the eastern side by the Boromo-Batie greenstone belt, in Burkina Faso, and by the Tehini-Hounde greenstone belt on the west.

The Company began extensive exploration at Doropo in 2016, building an extensive Mineral Resource. Since 2021, the company has announced three technical studies in three years, with a current Proven and Probable Mineral Reserve of 1.9Moz.

- May 2021 - Preliminary Economic Assessment (PEA)

- June 2023 - Preliminary Feasibility Study (PFS)

- July 2024 - Definitive Feasibility Study (DFS)

2023 Doropo NI43-101 Technical Report

2024 Doropo NI43-101 Technical Report

The Doropo landholding lies entirely within the granitic domain, bounded on the eastern side by the Boromo-Batie greenstones belt, in Burkina Faso, and on the western side by the Tehini-Hounde greenstones belt.

At the Project scale, the geology consists of fairly homogeneous medium to coarse grained granodiorite. Several of the deposits are intersected by regional, post-mineralisation diorite dykes.

Gold mineralisation occurs associated with discrete structurally controlled zones of intense silica- sericite alteration, focused within and along the margins of narrow (5-10 m wide to locally 20-25 m) shear zones. Outside of the mineralised zones, the granodiorite is fairly undeformed. The mineralised zones generally form clearly identifiable tabular bodies although this is complicated where two structures intersect, such as at the Nokpa deposit.

Gold grades within the mineralised zones are generally very variable and exhibit positively skewed grade distributions with relatively high Coefficients of Variation.

The currently defined mineral resource is formed of 13 deposits that lie within a 25km radius. 11 of these deposits are within a 7km radius, with Vako and Kilosegui 15km and 30km to the Southwest of the Main Cluster.

The DFS has resulted in a plan with significantly lower execution risk, relative to the PFS, reflecting a reconfiguration of the project to reduce its social impact on local communities. We were pleased to receive regulatory approval of the Environmental and Social Impact Assessment and receipt of the environmental permit in June 2024, and will shortly proceed to file the application for a mining license. Financing options for the project are well advanced, supported by a clear roadmap for early works that will mitigate completion risks. This study underlines our confidence in Doropo's potential to become a commercially viable project, bringing substantial investment and employment opportunities to northeastern Côte d'Ivoire.

- Mineral Reserve Estimate of 1.88 million ounces ("Moz") of Probable Mineral Reserves, at an average grade of 1.53 grams per tonne of gold ("g/t Au"), supporting a 10-year life of mine ("LOM")

- Upside opportunities identified including potential resource and reserve growth, to be explored utilising cashflow following first production

- Average annual gold production of 167koz over the LOM, with an average of 207koz in the first five years

- All-in sustaining costs ("AISC") of US$1,047 per ounce ("/oz") sold over the LOM, with an average AISC of US$971/oz for the first five years at US$1900/oz gold price

- Mining and processing operations remain consistent with the Pre-feasibility Study ("PFS"), utilising open-pit mining and a carbon-in-leach ("CIL") processing circuit

- Fulfils Centamin's hurdle rate of 15% internal rate of return ("IRR") at the US$1450/oz gold price used for Mineral Reserve estimation

- Robust economics with a post-tax net present value of US$426 million, 34% IRR and a 2.1 year payback using an 8% discount rate ("NPV8%") and US$1,900/oz gold price (a sensitivity analysis is available on page two)

- Total construction capital expenditure ("capex") of US$373 million, inclusive of contingency, representing an increase of less than 7% from the 2023 PFS

- A significant reduction in the need for community resettlement from estimates in the PFS of 2000 to 3000 persons, to less than 500, meaning no resettlement will be required during the construction period and the first 2 years of commercial operation

- The Environmental permit was received in June, following the Q1 2024 submission of the ESIA, endorsing the Company's management plans. Alongside the DFS this will support the mining license application

- An early works plan to be undertaken ahead of a financial investment decision will reduce project delivery risk and potentially expedite construction timelines

PROJECT OVERVIEW

Mining & geology

- 8 pits, shallow dipping structures with consistent geology

- Truck and Shovel, Multiple shallow pits

- 4.9x, LOM Strip Ratio (waste to ore)

Processing

- SAG/Ball mill and CIL, Conventional flowsheet

- Avg. 4.4Mtpa Throughput, 4.0Mtpa (fresh ore)

5.4Mtpa (oxide/transition ore) - 75/106 Micron Grind Size, Non-Refractory

- 89% Gold recovery over the LOM

Infrastructure

- Tailings storage facility, fully geomembrane lined, downstream construction

ANCOLD, GISTM Guidelines - 90kV national Ivorian grid

- 55km connection from Bouna sub station

NEXT STEPS:

The Company completed extensive work during the DFS stage. The DFS, together with the environmental permit will form key documents in support of our submission for a mining license to the Côte d'Ivoire Government. This application is scheduled to be submitted in Q3 2024. Following the award of the mining license and conclusion of the mining convention, we will be well positioned to make a final investment decision, with project financing options already well advanced.

There is up to US$6 million identified for early works including, starting front-end engineering design ("FEED"), grade control drilling and some limited earthworks. These activities will reduce project delivery risk and potentially expedite construction timelines. The costs will be removed from the current project operating and capital costs, with early works expenditure deducted from the total construction cost, and the grade control drilling costs deducted from the mining operating budget for the first two years, ensuring no additional costs are added to the current project values.

PROJECT UPSIDE OPPORTUNITIES:

There remains further upside opportunities which will be assessed during the DFS, including:

- Mineral Resource upgrades

- Resource extensions along strike

- Regional exploration of target areas

- Operational cost-saving optimisation

- Construction cost-saving opportunities

MINERAL RESOURCES

Inclusive of Mineral reserves. Please refer to the Group Reserve and Resources page for all notes.

Cut-off grades: 0.3g/t

| October 2023 | |||

| Category | Tonnage (Mt) | Grade (g/t) | Gold Content (Moz) |

| Measured | 1.5 | 1.6 | 0.1 |

| Indicated | 75.3 | 1.25 | 3.0 |

| Measured +Indicated | 76.9 | 1.26 | 3.1 |

| Inferred | 7.4 | 1.23 | 0.3 |

MINERAL RESERVES

Varied cut-offs 0.39g/t to 0.71g/t

| July 2024 | |||

| Category | Tonnage (Mt) | Grade (g/t) | Gold Content (Moz) |

| Proven | 1.3 | 1.73 | 0.1 |

| Probable | 37.0 | 1.52 | 1.8 |

| P & P | 38.2 | 1.53 | 1.9 |